|

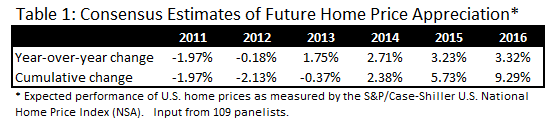

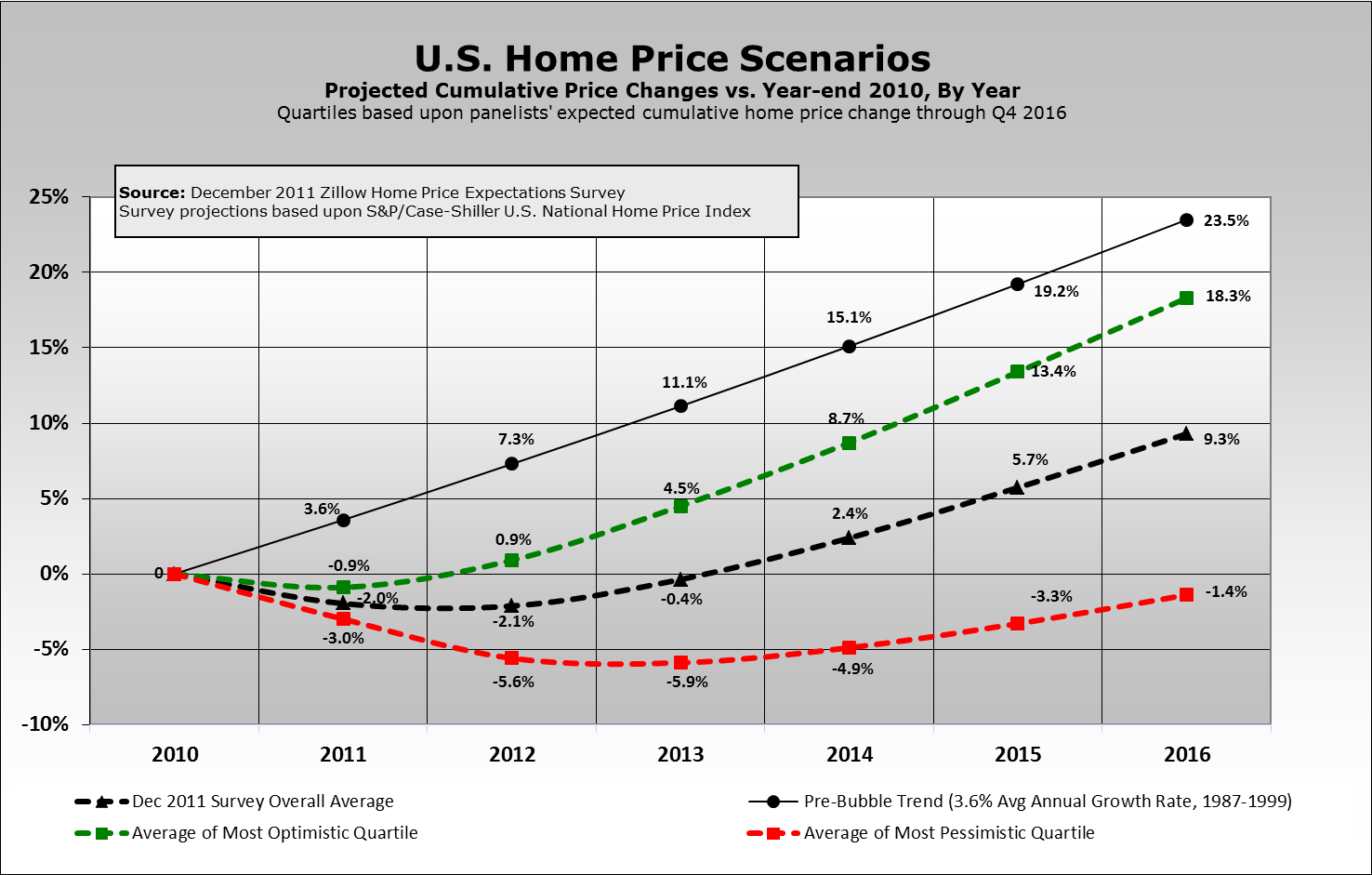

Experts Continue to See Long Road Ahead in Housing Recovery By: Stan Humphries The latest data from the December Zillow Home Price Expectations Survey show that housing experts foresee further home price declines next year and a more protracted bottom in the housing market than they foresaw a year and a half ago. The survey, compiled from 109 responses by a diverse group of economists, real estate experts, investment and market strategists, asks about the projected path of the S&P/Case-Shiller U.S. National Home Price Index over the next five years. The survey participants believe that home prices will fall 1.97% between the fourth quarters of 2010 and 2011 and will fall another 0.18% by the end of 2012 (see Table 1). Thereafter, they see positive and modestly increasing home price appreciation in 2013 and beyond. By the end of 2016, the respondents believe home prices will be just 9% higher than they are today.

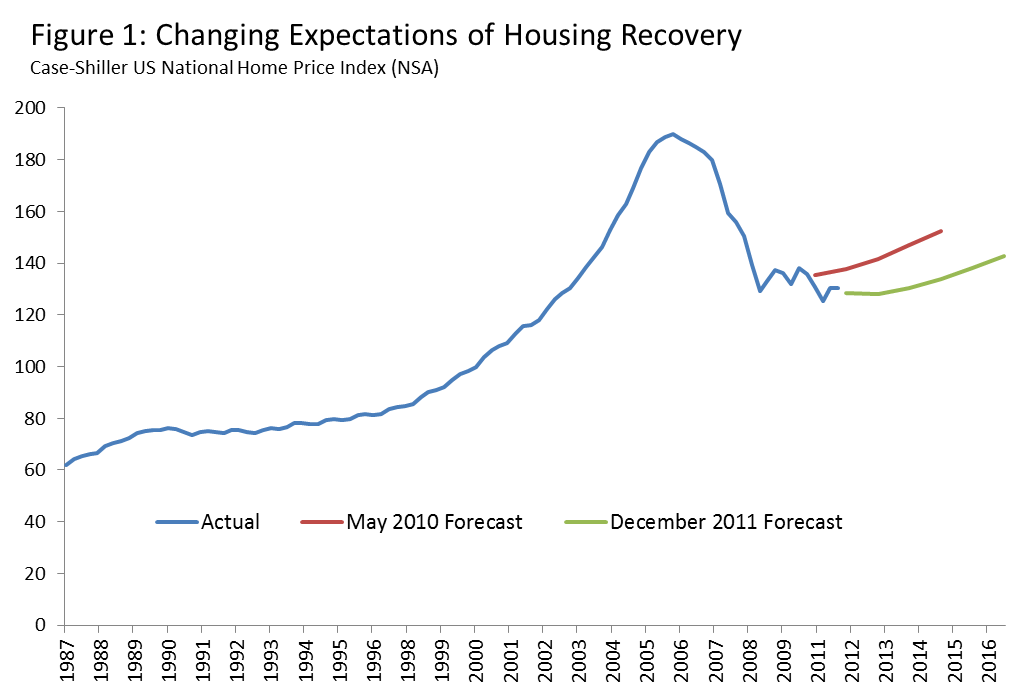

The aggregate assessment of panelists in the most recent survey represents a substantial change from the opinion registered in the first Home Price Expectations Survey fielded in May 2010. At that time, experts foresaw much more of a V-shaped recovery in the housing market with prices in 2014 rising more than 12% above their 2009 levels. Now, the average opinion is that prices by 2014 will be 1.6% below their end-of-year 2009 levels and only 2.7% above current levels. The consensus opinion is much more of a U-shaped recovery at this point (see Figure 1).

A sign of the magnitude of the housing recession is that, even assuming the consensus forecast becomes reality and the housing market experiences 4% appreciation beyond 2016 (quite robust by historical standards), home prices won’t return to peak levels again until 2024 (18 years after their peak). To see who the bulls and bears are on the housing market, check out the interactive visualization below. Note: The Zillow Home Price Expectations Survey was conducted December 1-14, 2011 by Pulsenomics, LLC on behalf of Zillow.

|

| © 2006 - 2022. All Rights Reserved. |