|

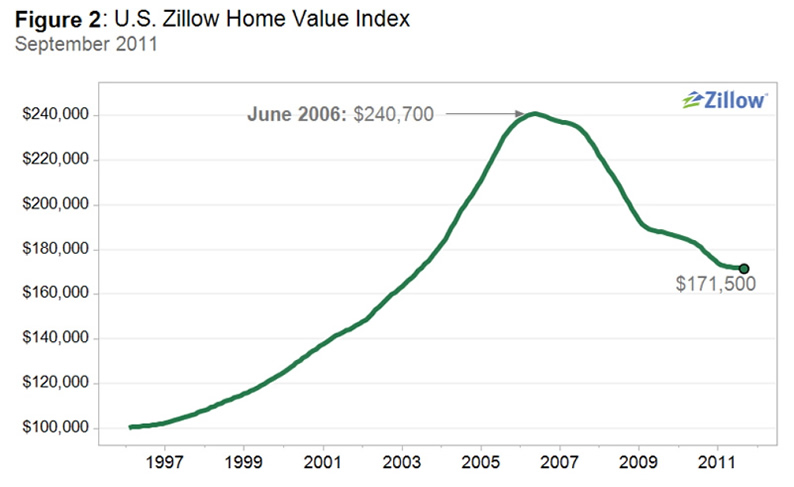

Zillow: Market Will Not See Bottom Until at Least 2012 Outlook On a year-over-year basis home values were down 4.4 percent with the Zillow Home Value Index at $171,500 (Figure 2). Unemployment and negative equity, paired with fragile consumer confidence, remain the key factors preventing the housing market from stabilizing. We see little evidence that the recent reductions in the conforming loan limits have materially impacted the market, and data from the Zillow Mortgage Marketplace indicate that borrowers below the old limit and above the new limits are getting rates about 25 basis points higher than they were before. According to our estimates, these changes affected less than 0.75 percent of all homes in the country. Negative Equity

|

| © 2006 - 2022. All Rights Reserved. |