|

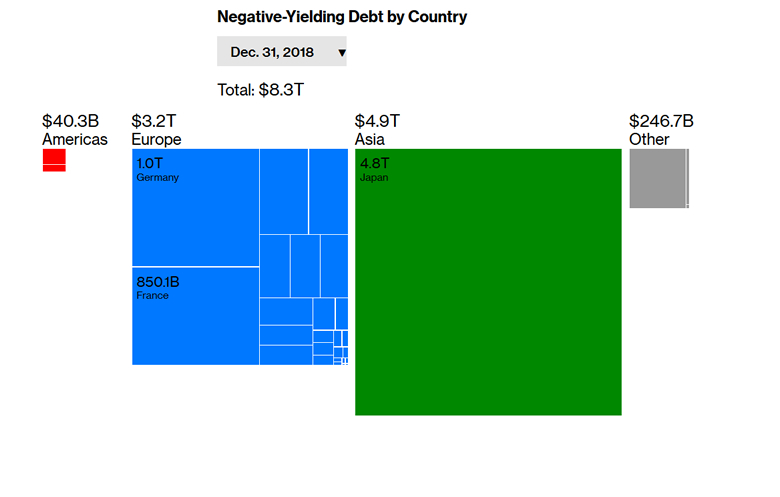

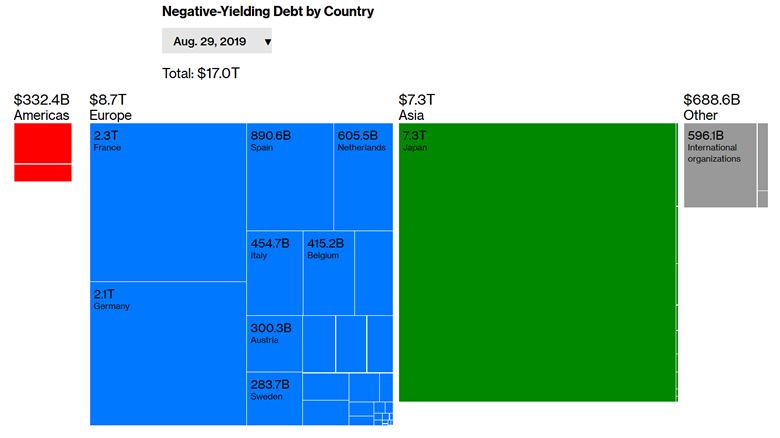

Financial Chaos - the Unstoppable Surge in Negative Yields Reach $17 Trillion From Bloomberg: The global stock of negative-yielding debt is now in excess of $17 trillion as rising market volatility lends extra force to this year’s unprecedented bond rally. Thirty percent of all investment-grade securities now bear sub-zero yields, meaning that investors who acquire the debt and hold it to maturity are guaranteed to make a loss. Yet buyers are still piling in, seeking to benefit from further increases in bond prices and favorable cross-currency hedging rates—or at least to avoid greater losses elsewhere. The negative-yield phenomenon is turning financial markets on their head—raising the specter of a bond bubble, draining pension funds of a valuable source of income and incentivizing riskier companies to mortgage their assets. At the same time, banks are having to reassure citizens that they won’t suddenly start charging customers to store their money. ...Corporate bonds are also contributing, with a recent sale by Siemens AG drawing the most negative yield ever... How to Get a Negative Yield How can a bond have a negative yield? It starts when an investor buys a bond for more than its face value. If the total amount of interest the bond pays over its remaining lifetime is less than the premium the investor paid for the bond, the investor loses money and the bond is considered to have a negative yield. Investors are willing to pay a premium—and ultimately take a loss—because they need the reliability and liquidity that government and high-quality corporate bonds provide. Large investors such as pension funds, insurers, and financial institutions may have few other safe places to store their wealth.

|

| © 2006 - 2022. All Rights Reserved. |