|

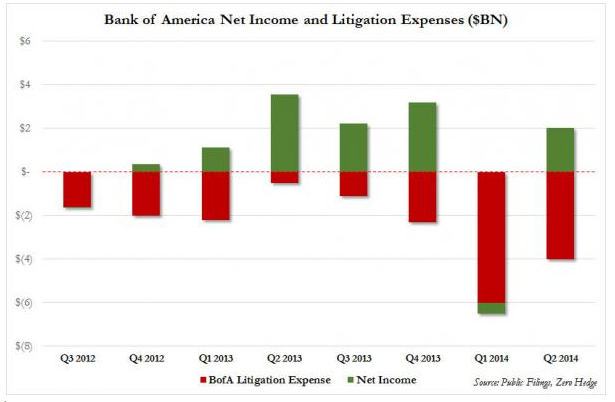

BofA’s $30B Litigation Problem is Getting Worse Mortgage banking tanks as BAC fails to limit litigation costs

Bank of America’s (BAC) mortgage-related litigation costs are something the banking giant wants to put behind it, but good luck with that, because it’s only going to get worse before it gets better. Over the past two years, BAC has incurred $20 billion in litigation charges at the same time that its net income over those two years was $11.9 billion. This quarter, Bank of America reported that its second-quarter profits plummeted 43%, largely attributed to falling mortgage revenue and increasing litigation costs.

BAC’s real estate services division was an albatross around the bank’s neck, posting a loss of $2.8 billion in the second quarter of 2013, compared to losses of $930 million in the second quarter of 2013. BAC made just $13.7 billion in home loans in the second quarter, a free fall of almost 50% from the second quarter of 2013, while first mortgage originations flat out crashed, falling 60% year over year. BAC’s mortgage services portfolio collapsed from $780 billion to just $760 billion, down from $986 billion a year ago. Add that to today’s earnings statement, which has BAC reporting the lowest net interest yield in the company’s history at 2.22%, and what you get is really troubling. Above that neck draped with the albatross is BAC’s head. And above BAC’s head hangs the Sword of Damocles in the form of an ongoing investigation by the Department of Justice for fraudulent mortgage securities practices during the financial crisis. With Citigroup and JPMorgan having recently hammered out a deal with the DOJ over the same kind of RMBS fraud, pressure is on BAC to settle, but the bank isn’t seeing eye-to-eye with the DOJ. BAC is offering $13 billion in negotiations, reports say, while the DOJ and regulators are holding out for closer to $17 billion. (Of the money from whatever settlement comes, about $5 billion is supposed to be dedicated to consumer relief through lowered principal and to help clear out neighborhoods blighted by foreclosures arising from the toxic mortgages the bank sold.) That $17 billion figure is something that, in light of how badly its mortgage businesses is doing and other factors, the banking giant can ill afford, and which is causing analysts to steer investors away from BAC.

|

| © 2006 - 2022. All Rights Reserved. |