|

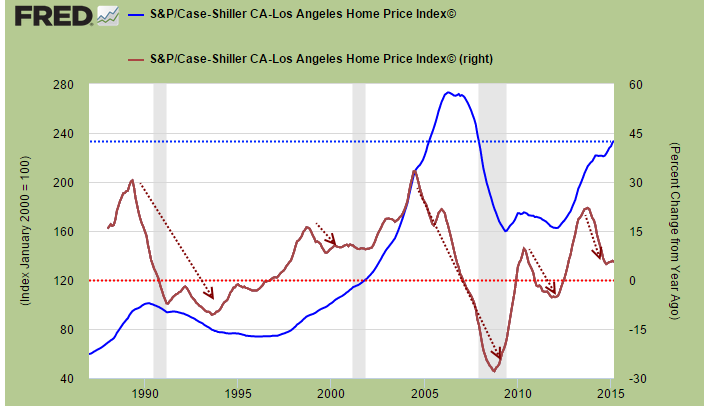

30 Years of Trends in the Los Angeles / Orange County Real Estate Market The boom and bust cycle is simply part of the California market. We’ve had a nice boom driven by investors and low inventory recently. But investors (those with big wallets) have pulled out dramatically early in 2014. Yet momentum is shifting but the question is, what will come about this change? People also forget that the stock market is on a six-year tear and California, especially the Bay Area has a deep connection between the two. Stocks are up and real estate follows. It is interesting to see that the stock market this year is also unsure of what it wants to do. It might be helpful to look at the Case-Shiller Index for the Los Angeles market. The index also pulls in Orange County data so it is a nice overview of a very big market. Here is data going back 30 years:

The blue line is the Case-Shiller Index with no adjustments. You can see the recent big bounce up. The red line shows momentum changes in the form of year-over-year changes. You can see that the trend is definitely heading lower. Of course, these changes happen over years. For those in the market looking at a $700,000 crap shack, you are really betting against the above chart. It is interesting that many in California will look at the stock market as some kind of risky proposition, even when placing a $50,000 bet. Yet some see no problem buying a $700,000 home requiring a $140,000 down payment to get down to a modest monthly mortgage payment. A small 10 percent correction (see chart above) would wipe out a nice chunk of change. Those going in with low down payments might be in a position where equity is at par (or below given selling costs). More to the point, price-to-income ratios are incredibly out of whack.

|

| © 2006 - 2022. All Rights Reserved. |