|

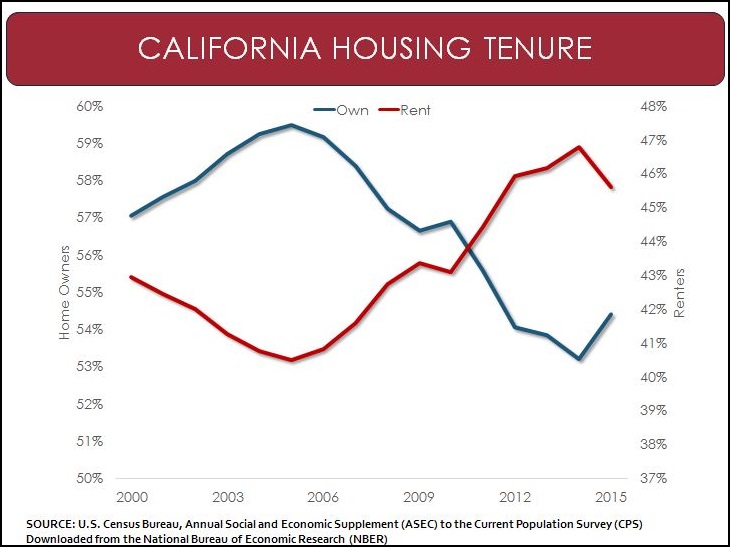

Increase of Rental Units Contributing to California’s Tight Housing Inventory There are many reasons that inventories remain tight in the state, with a notable list of reasons including: However, there is another aspect of the current inventory challenges that has been discussed only infrequently, but which is also having an effect on the number of homes available for sale—single-family rentals. In the run-up to the housing collapse, California experienced an unprecedented rise in home ownership, which hit an apex at nearly 60% of households back in 2005. With the housing bust, many of these newly minted homeowners received a notice of default or had their homes foreclosed upon by their bank.

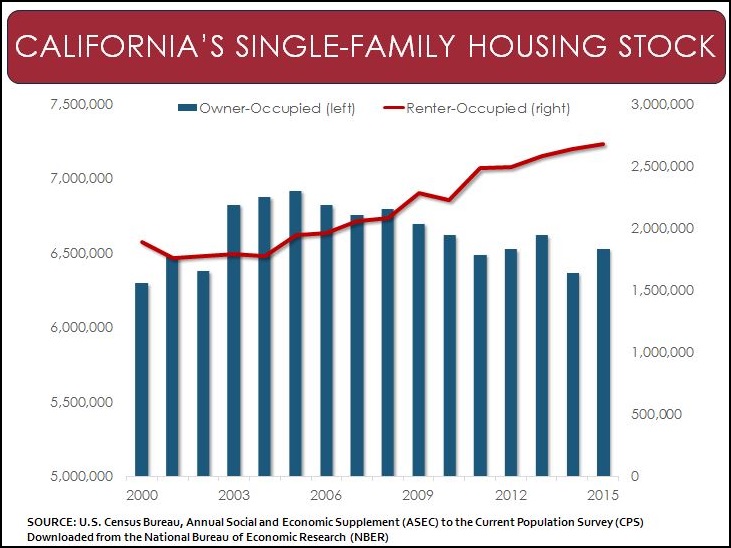

As a result, there was an equally sharp decline in the number of single-family owners and a corresponding increase in the number of renters in the state. Yet, perhaps more relevant to the supply discussion is not what happened to these households, who either moved from owning to renting, but what happened to the housing units that they used to live in. Specifically, between 2005 and 2014, there were 550,000 fewer single-family owner-occupied properties, while the number of single-family rentals jumped by nearly 700,000. From this perspective, it is clear that the ripple effects of the Great Recession are still having an impact on inventory today, despite the fact that demand continues to improve and many of these former homeowner-come-renters have already waited the requisite 7-year period (3 years for short sales) when they would be eligible to purchase a home again. This data suggests that at least 550,000 single-family units (perhaps as many as 700,000) have been taken out of the housing stock altogether as investors snapped them up to convert into rentals as homeownership rates were unwinding. With housing turnover currently running at roughly 5%, that is as much as 35,000 fewer homes transacting each year simply on the basis of not being in the pool of potential properties to sell. It is unclear when this trend will reverse course: rents remain high, so it remains a smart financial play for landlords to remain in the rental business. And as yet, there has only been a minimal uptick in homeownership which would drive price growth higher and incentivize landlords to add these properties back into the owner-occupant mix. What’s more, many landlords have had to invest in the knowledge, expertise, and experience to successfully manage their properties. It is reasonable to assume that these will be difficult investments to walk away from without a strong price incentive—especially in today’s high-rent, low rental vacancy environment.

As such, the aftermath of the Great Recession on the structure of our housing stock will likely continue to exacerbate the other issues affecting housing supply over the next year.

|

| © 2006 - 2022. All Rights Reserved. |