|

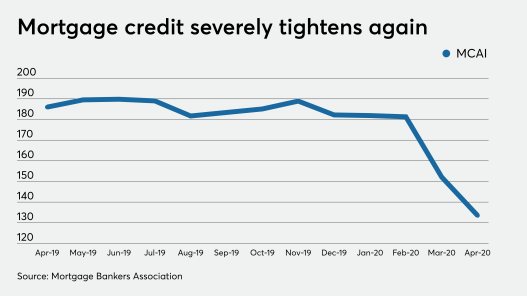

Coronavirus Causes Mortgage Lenders to Cut Credit to a 5-year Low Mortgage credit availability is at its tightest in over five years as originators pull their riskier loan product types from the marketplace because of the coronavirus. Contributing to credit clamp-up were broad-based changes in secondary market guidelines from the government-sponsored enterprises and federal agencies. In addition, issuers in the private-label market tightened their standards as well, which caused some non-qualified mortgage lenders to suspend business.

The Mortgage Banker Association's Mortgage Credit Availability Index fell 12.2% to 133.5 in April from March's 152.1 (which was a decline of 16% from February). This is the tightest credit has been since December 2014. In April 2019, the index was 186. By product segment, the conventional MCAI fell 15.2% from March, driven by a 22.6% decline in the jumbo index. The portion of the conventional MCAI that measures conforming product availability fell by 7.1%.

|

| © 2006 - 2022. All Rights Reserved. |