|

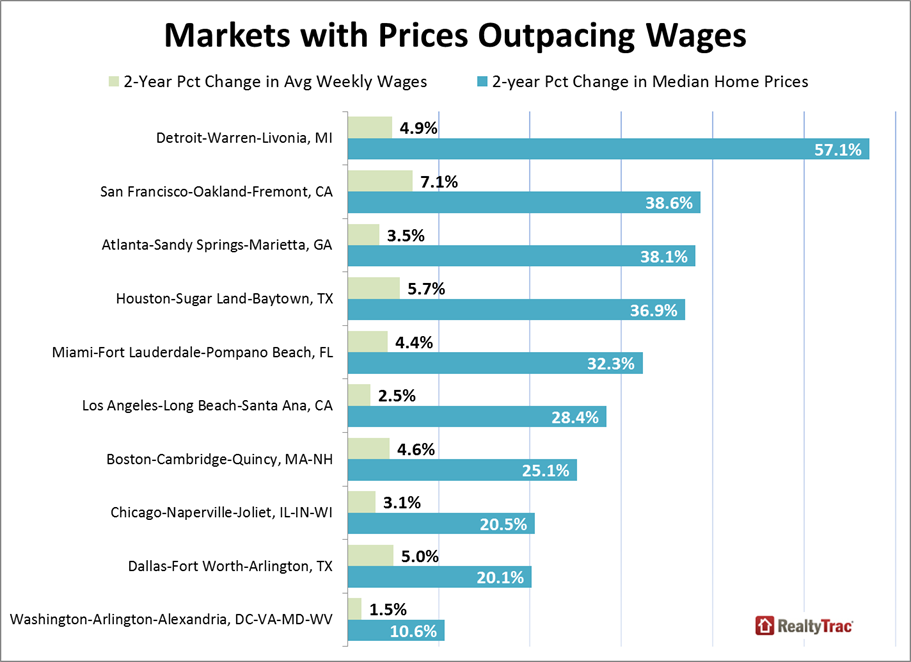

U.S. Home Prices Are Surging 13 Times Faster Than Wages Bloomberg - For most people, buying a home is no cheap venture. That's especially the case when the growth in U.S. home prices is beatingwage increases 13 to 1. Wages climbed by 1.3 percent from the second quarter of 2012 to the second quarter of 2014, compared to a 17 percent increase in home prices around that time, according to a new report from RealtyTrac. The real-estate data provider used the Labor Department's weekly earnings data to measure wage growth, while home prices were derived from sales-deed data in December 2014 and compared to December 2012 on the hypothesis that a change in average wages would take at least six months to affect home prices. Using localized earnings data, RealtyTrac also found that 76 percent of housing markets posted increases in home prices that exceeded the wage growth there during that time frame, led by the regions of Merced,California; Memphis, Tennessee; Santa Cruz, California; and Augusta, Georgia. Others include the Detroit, Houston and Miami regions. (To be fair, some of these areas are still considered affordable and experienced massive price drops during the housing bust and recession.)

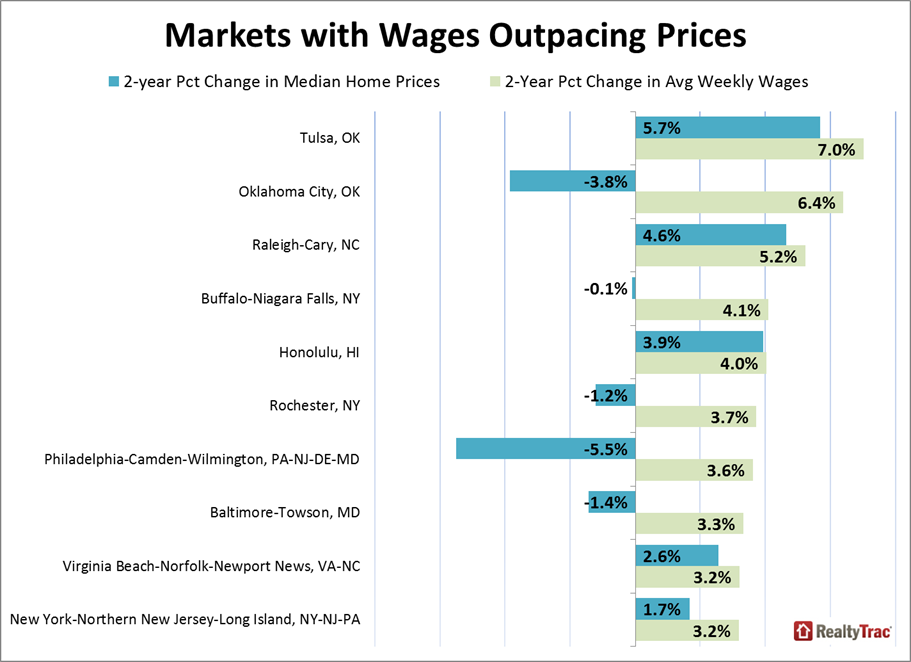

How could this happen? Enter the investor. In many markets, the housing recovery has "largely been driven over the last two years by buyers who are not as constrainedby incomes -- namely the institutional investors coming in and buying up properties as rentals, and international buyers coming inand buying, often with cash," Daren Blomquist, vice president at RealtyTrac and author of the report, said in an interview. For demand from traditional buyers to improve, "either wages are going to need to go up or prices are going to need to at least flatten out and wait for wages to catch up," he said. "You might say the third alternative is interest rates go down so you give people more buying power with their wages, but interest rates are about as low as they can go." The trend illustrates the limited impact of the Federal Reserve's decision to include mortgage-backed securities in its unprecedented asset-buying program.The Fed bought more than $1 trillion of those securities to prop up the housing market after it collapsed and helped trigger the worst recession in the post-World War II era. With the economy improving and home prices climbing, central bankers seem to have achieved at least part of their goal. However, investors have reaped much of the benefits of rising prices, while meaningful wage growth--and with it the ability of many Americans to buy homes -- has yet to materialize. That's been one reason housing has posted such inconsistent progress over the past two years, even with mortgage rates near historical lows. The 24 percent of markets where wage growth outpaced home price appreciation from 2012 to 2014 include Tulsa, Oklahoma; Raleigh, North Carolina; Virginia Beach, Virginia; and New York, according to the RealtyTrac data. However in some places, such as the Baltimore region, it's only because home prices fell during that time period.

In such regions, there may be "a lot of distress those places are working through," Blomquist said. Though for someone who's looking for a more "emerging market" where prices have more room to run, "maybe that's a good opportunity," he said.

|

| © 2006 - 2022. All Rights Reserved. |