|

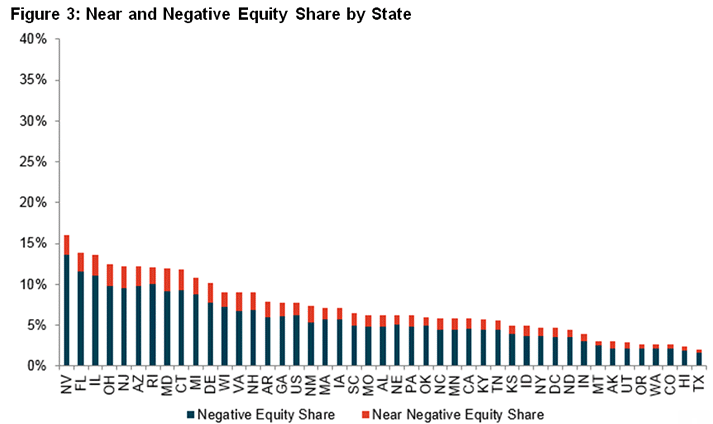

1 Million Borrowers Regain Equity in 2016 According to CoreLogic 48 million homes, about 93.8 percent of those with a mortgage, now have positive equity. Negative equity peaked at 26 percent of mortgaged residential properties in Q4 2009 based on the company's equity data analysis, which began in Q3 2009. Negative equity, often referred to as being "underwater" or "upside down," applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both. The mortgaged homes that remained in negative territory at the end of the fourth quarter of 2016 numbered 3.17 million, a 6.2 percent rate. This is down 2 percent from the third quarter's total of 3.23 million homes or 6.3 percent of all mortgaged homes, and down 25 percent from the fourth quarter of 2015 when there were 4.23 million homes without equity. Average home equity in the United States rose by $13,700 for U.S. homeowners during 2016. Home-price appreciation was slower in California at 5.8%, the high price of housing there led to California homeowners gaining an average of $26,000 in home equity wealth last year. The total amount of negative equity totaled $283 billion at the end of the fourth quarter. This is down 0.3% or $700 million from the third quarter and down 8.4% or $26 billion from last year.

|

| © 2006 - 2022. All Rights Reserved. |