|

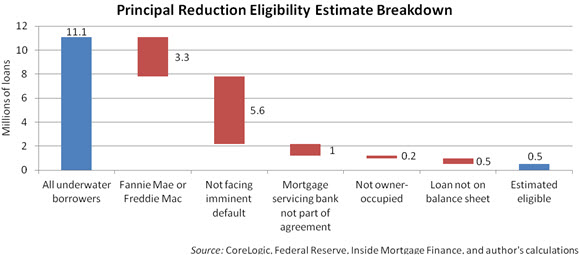

500,000 Borrowers May Qualify for Principal Reduction Under the Mortgage Settlement The much publicized $25 billion settlement agreement announced in February between the state attorneys general and the five largest mortgage servicers called for at least $10 billion to be dedicated to reducing the principal of underwater borrowers. But only certain types of underwater loans are eligible. Below I attempt a back-of-the-envelope calculation of the number of eligible loans, with the numbers depicted in the figure at the bottom. The calculation is a rough one, since I rely on different data sources, and since I need to resort to some simplifying assumptions. For example, if 40 percent of underwater borrowers meet one criterion for eligibility and 20 percent of underwater borrowers meet another criterion, then I assume that 8 percent (40 percent times 20 percent) meet both criteria. First, the borrower must be underwater, meaning owing more in mortgage debt than the house is worth. According to CoreLogic, there are 11.1 million underwater borrowers. Second, loans backed by Fannie Mae or Freddie Mac are not eligible for the principal reduction. According to analysis by the Federal Reserve of data from LPS Applied Analytics and CoreLogic, as of December, 14.1 percent of Freddie Mae loans were underwater and 11.3 percent of Fannie Mae loans were underwater. Taking the midpoint, and assuming there are 26 million Fannie or Freddie loans (about half of the number of existing loans), then there are approximately 3.3 million Fannie and Freddie underwater loans, bringing us to 7.8 million remaining borrowers eligible for the principal reduction. Third, the borrower must be delinquent or facing imminent default to qualify for the principal reduction. According to the Federal Reserve (PDF), approximately 28 percent of underwater borrowers are not current on their payments, bringing us to 2.2 million remaining borrowers. Third, the agreement is with the five largest mortgage servicing banks. According to Inside Mortgage Finance, the five banks service 55 percent of all loans, bringing us to 1.2 million remaining borrowers. Fourth, only owner-occupied homes are eligible. According to CoreLogic, 82 percent of underwater borrowers are owner occupied, bringing us to 1 million remaining borrowers. There is another complication, in that some of these loans are held on the banks’ balance sheets, and others are part of mortgage-backed securities owned by outside investors. For the latter, the banks are contractually obligated to minimize losses to the investors, meaning it is unlikely they can reduce principal on these loans without facing the ire (and possible lawsuits) from the investors. Department of Housing and Urban Development Secretary Donovan acknowledged this problem by suggesting that the banks will target the principal reductions to the loans that they hold on their balance sheets. According to CoreLogic, about 41 percent of underwater borrowers had home equity loans, which typically are held on banks balance sheets. So even if these borrowers’ first loans do not qualify for a principal reduction, their second loans – which represent the bulk of their negative equity – do. Also according to CoreLogic, about 9 percent of underwater borrowers had no second loan and had their first loan held on banks’ balance sheets. Applying this 50 percent leaves us an estimate of 500,000 loans eligible for the principal reduction. ...if the estimate is correct of 500,000 eligible loans, then this represents less than five percent of the universe of underwater borrowers. If each of these eligible borrowers were to apply for and receive a principal reduction, then the $10 billion allotted for principal reduction in the settlement agreement would amount to an average of $20,000 per eligible underwater borrower.

|

| © 2006 - 2022. All Rights Reserved. |