|

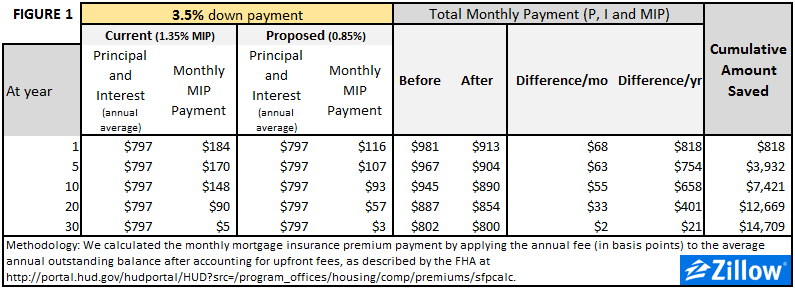

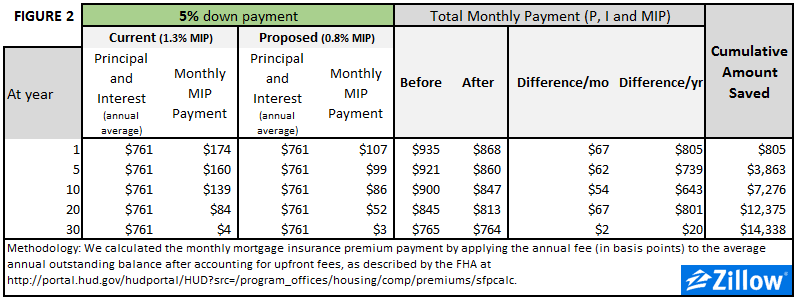

Lower FHA Insurance Premiums Start in February After 30 years, a borrower putting down 3.5 percent could save more than $14,700, monthly savings only $68.00 on $175,000 average US home purchase. After 30 years, a borrower putting down 5 percent would save more than $14,300, monthly savings only $67.00 on $175,000 average US home purchase.

FHA mortgage premiums are paid annually in 12 monthly installments, on top of principal, interest and insurance. For new FHA loans, the premiums must be paid over the entire life of the loan, unlike pre-2013 loans where mortgage insurance was waived after homeowners achieved 20 percent equity in their home. According to a statement released by the Obama Administration, the lowered premiums are expected to help more than 800,000 existing homeowners (through refinancing) and lure up to 250,000 new buyers into the market in the first year. If the expectations come true (a big if), those numbers would represent a big boost to sales volumes that remain below historic norms, even as the housing market overall has recovered well since bottoming in late 2011 and early 2012. The plan to lower FHA premiums is not without its critics. The FHA is required by law to keep a reserve fund with a capital ratio of 2 percent in order to cover any potential future losses from insured loans gone sour. During the housing crisis, this reserve fund was severely depleted, and FHA premiums were initially raised to help replenish the fund. The ratio currently stands at 0.41 percent, as of Sept. 30, still well below statutory levels. The White House said it is betting that added volume from more borrowers attracted by lower premiums will offset the cuts, noting that premiums of 0.85 percent and 0.8 percent are still well above historic levels around 0.55 percent. “This robust premium structure will more than cover the related estimated credit losses posed to the insurance fund from newly originated loans, continuing to strengthen the fund and protect taxpayers,” the White House said in a statement.

|

| © 2006 - 2022. All Rights Reserved. |